- Bloomberg – ‘Inflation Fever’ Is Finally Breaking — But Central Banks Won’t Stop Hiking Rates

Slowdowns on key commodity markets signal some relief is in store after worst price shock in decadesGlobal inflation is finally coming off the boil, even if it’s set to remain far too hot for the liking of the world’s central bankers. As economic growth slows, prices for key raw materials — from oil to copper and wheat — have cooled in recent weeks, taking pressure off the cost of manufactured goods and food. And it’s getting cheaper to move those things around, as supply chains slowly recover from the pandemic. After the worst price shock in decades, the speed at which relief arrives will vary, with Europe in particular still struggling. But for the world as a whole, analysts at JPMorgan Chase & Co. estimate that consumer-price inflation will fall to 5.1% in the second half of this year — roughly half of what it was in the six months through June.

Summary

Comment

The story above captures the widely held sentiment about inflation – it is a one time post-pandemic surge that is peaking and will soon go away, and probably for good.

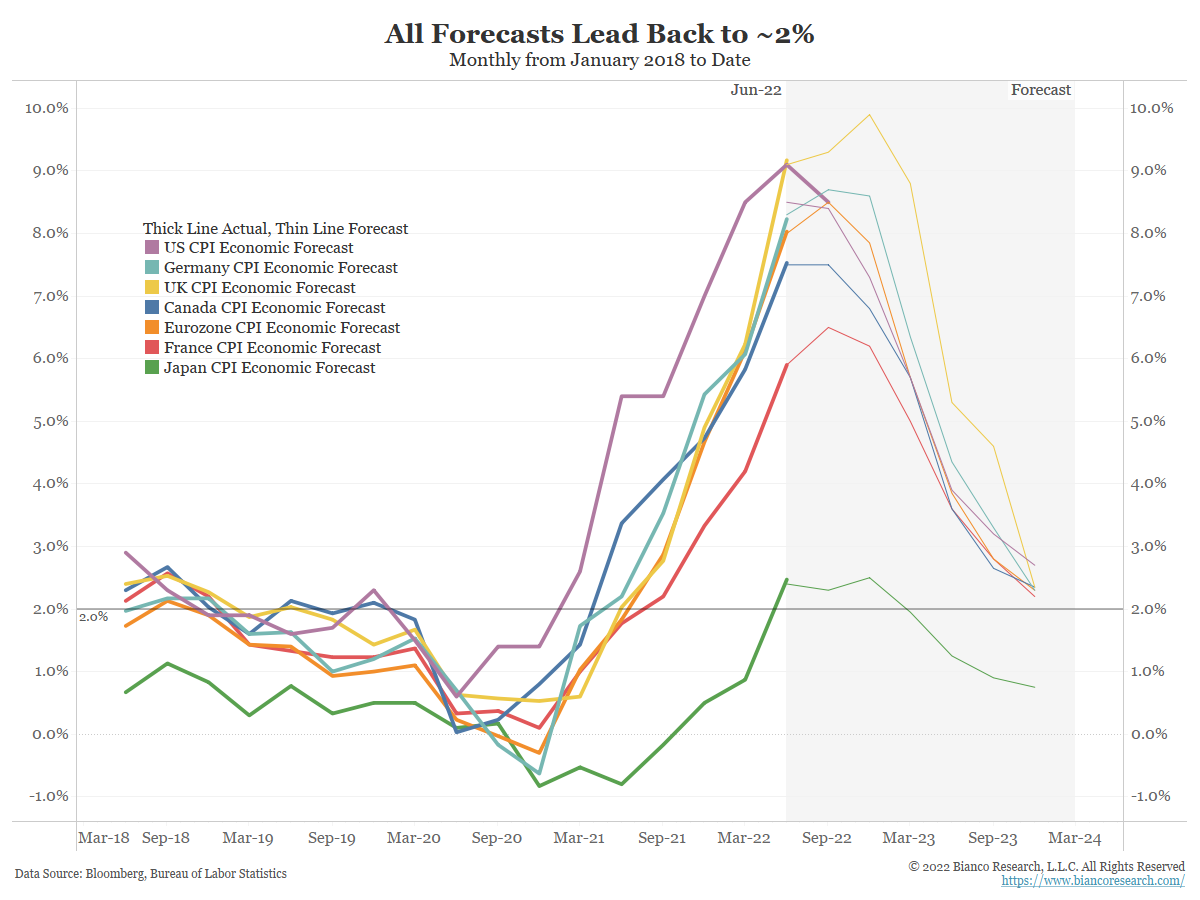

The chart above illustrates this belief. All the developed country forecasts (shaded area) are projecting inflation has peaked, or is about to peak (UK in yellow), and will quickly return to 2%.

The problem with this thinking is it mistakes economists’ projections with what will actually happen. Projection are important because they tell you what is expected. But do not mistake this for what will happen.

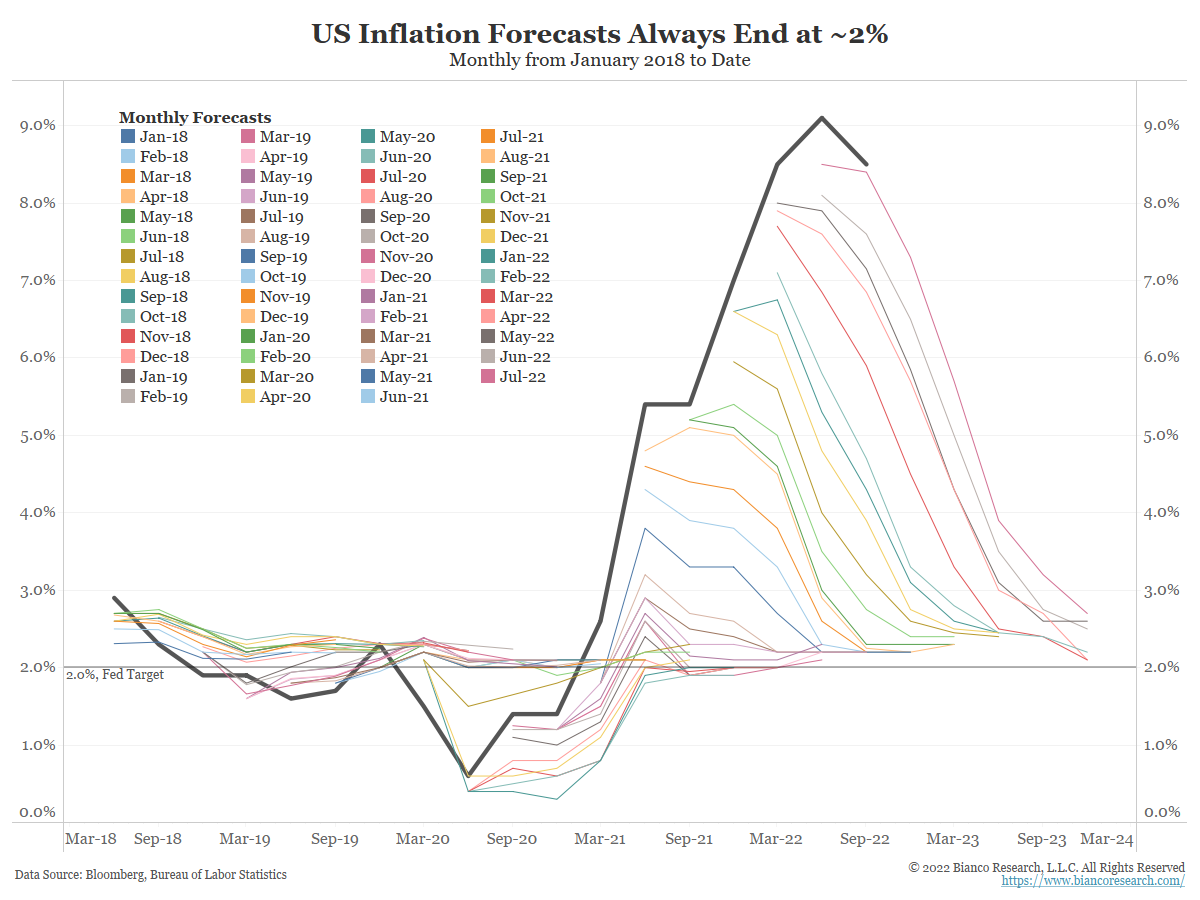

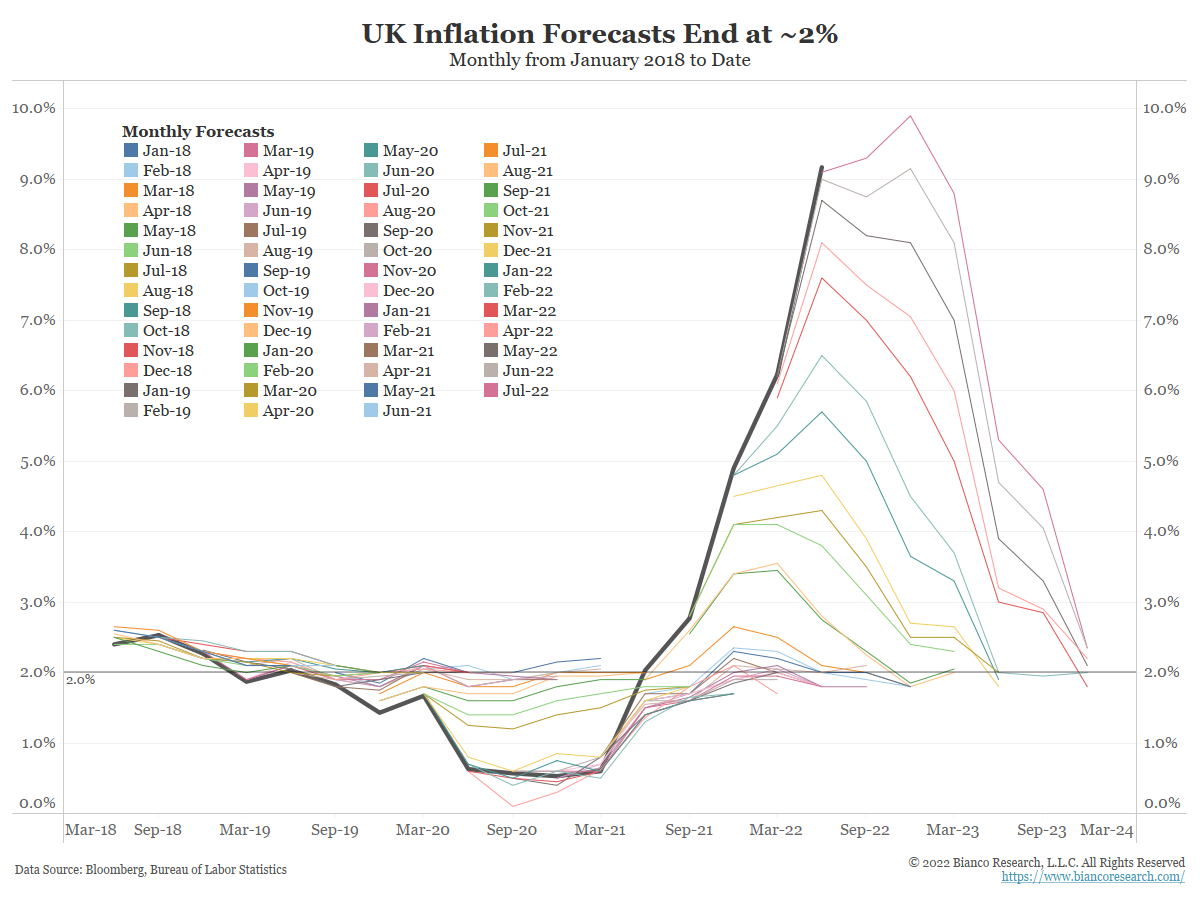

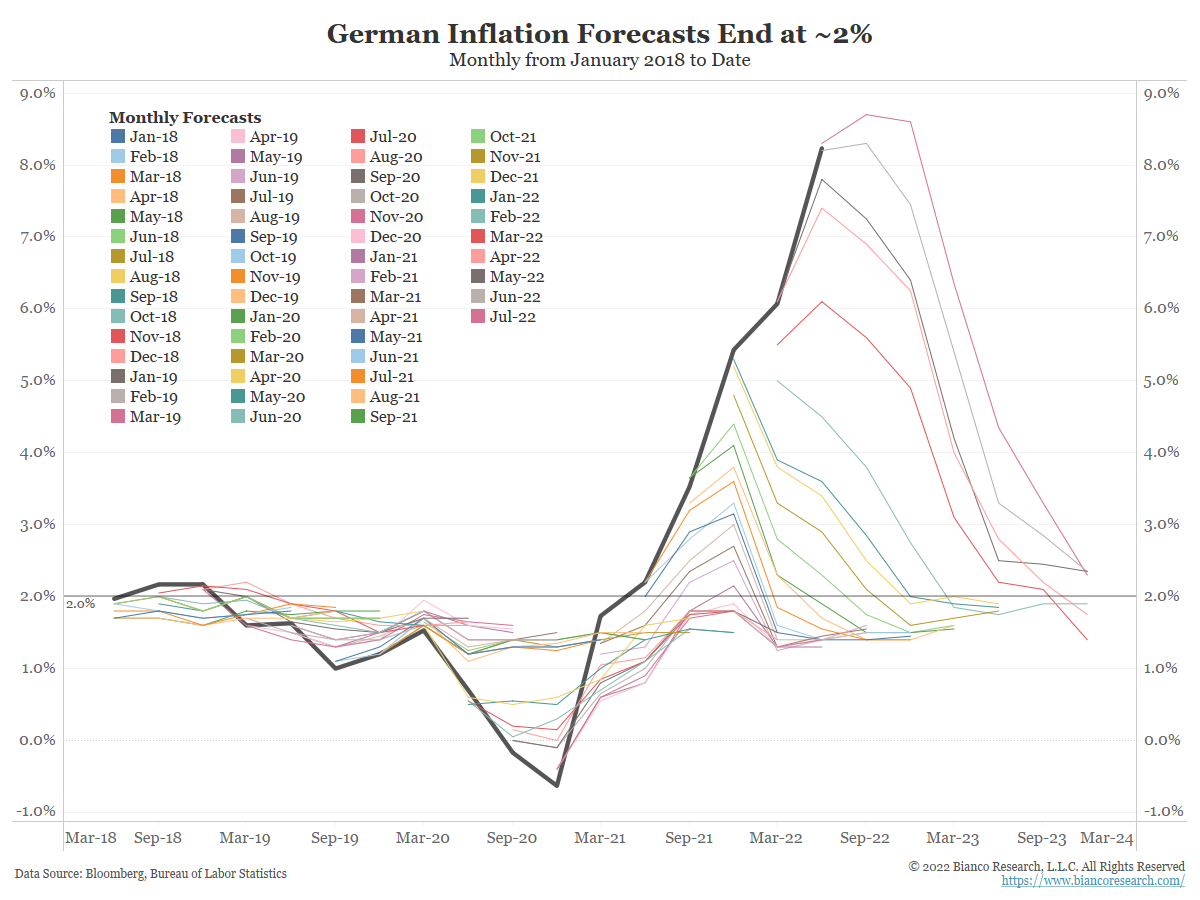

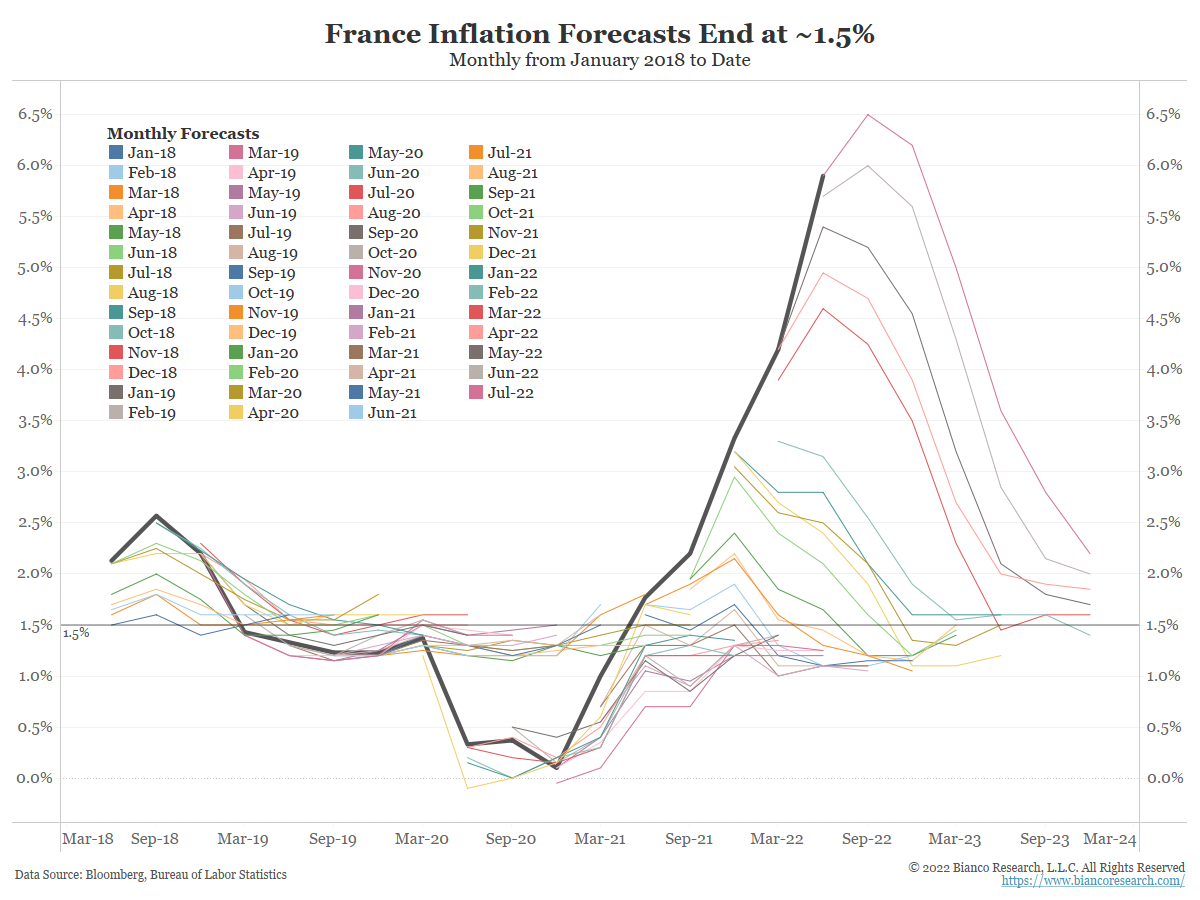

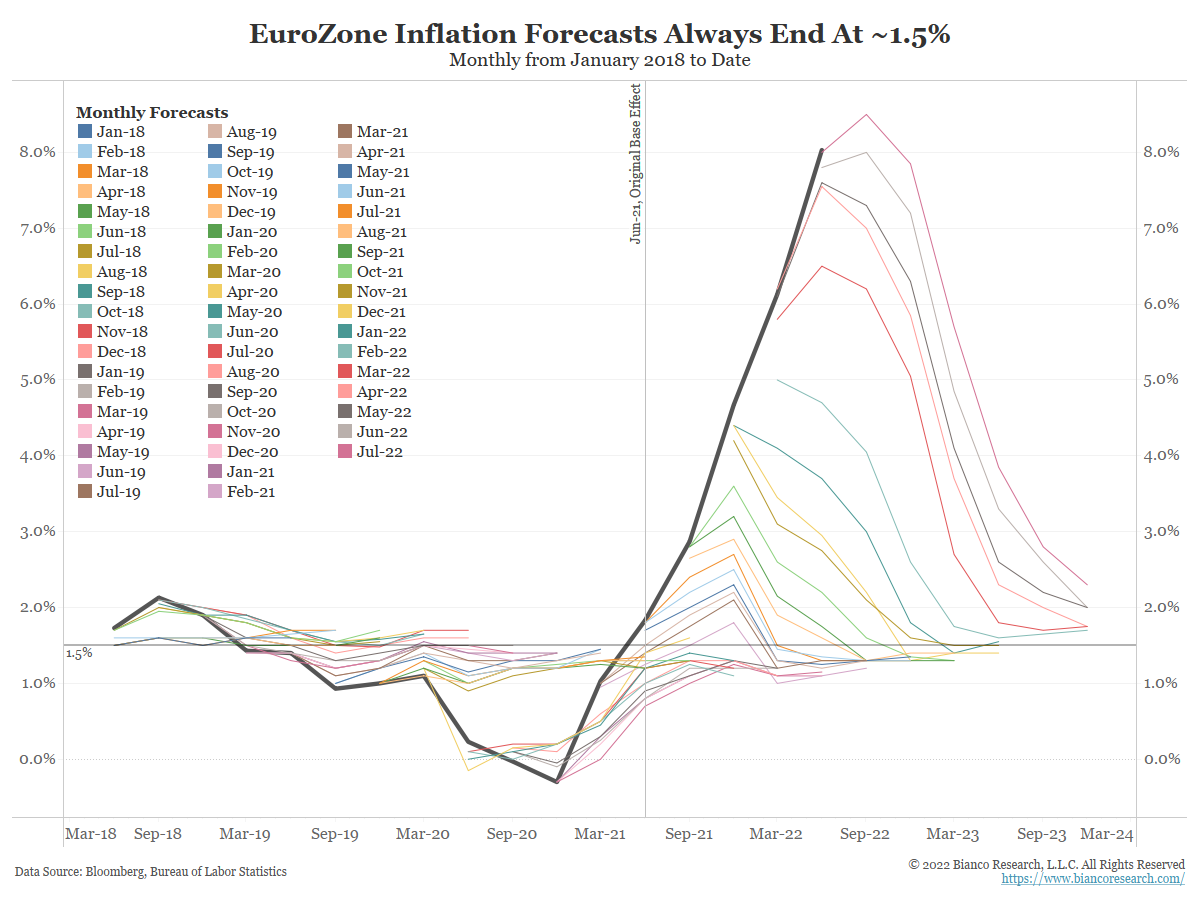

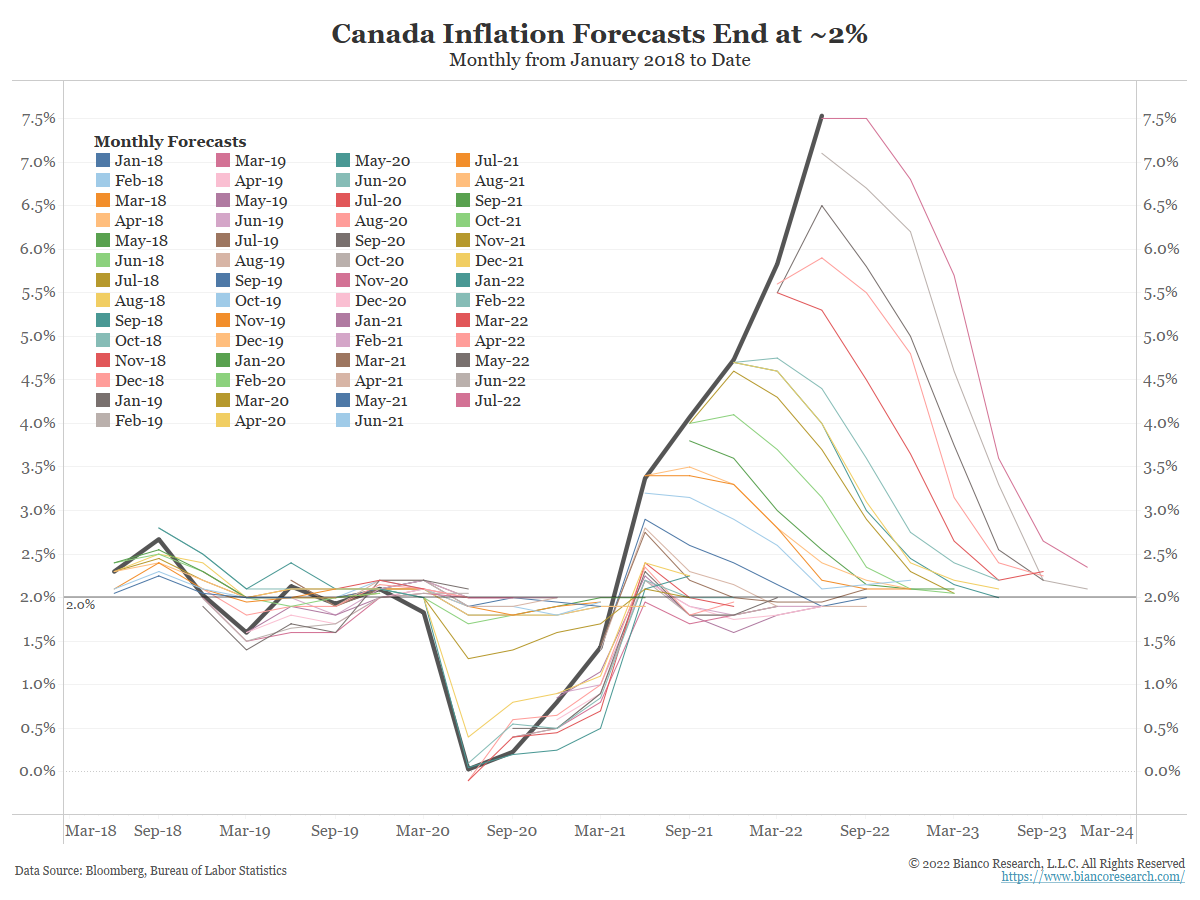

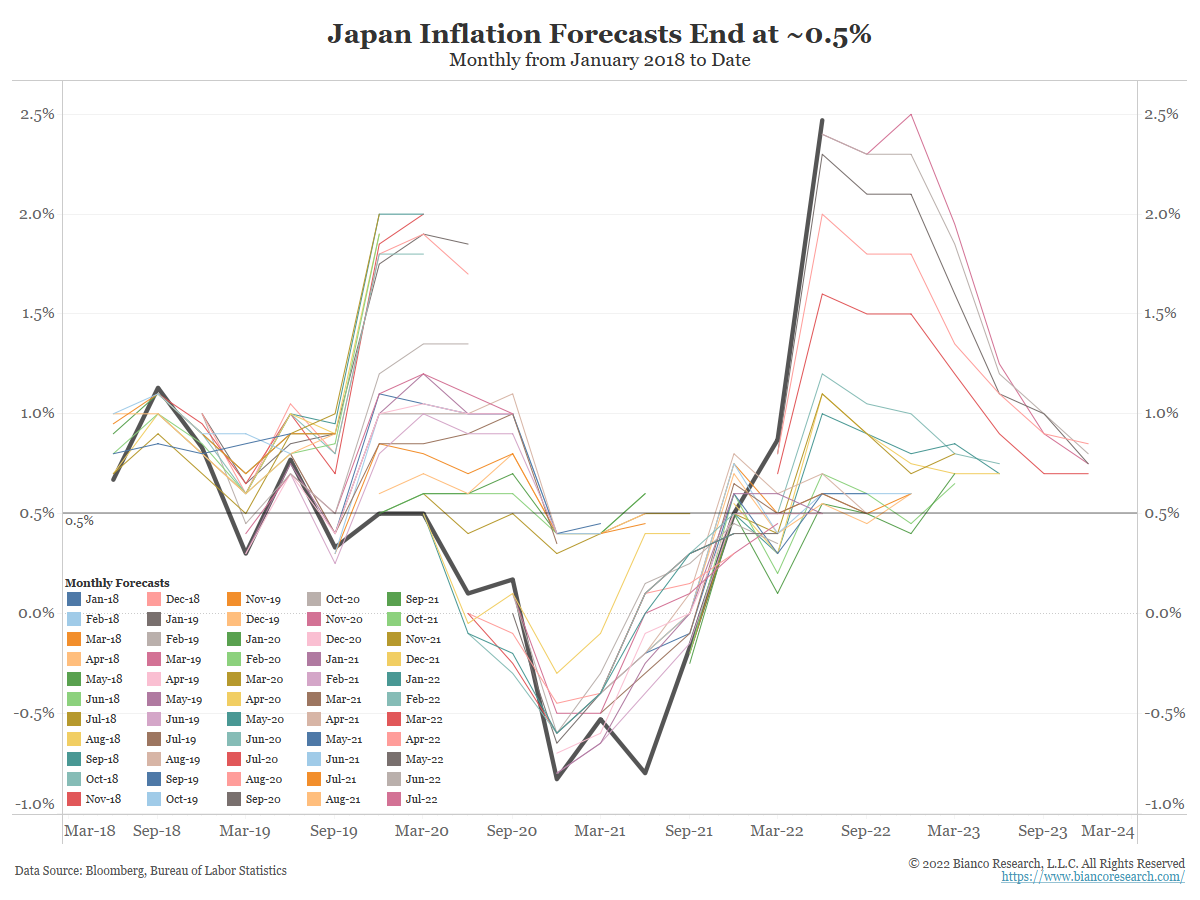

The following series of charts details recent inflation forecasts by country. They show the inflation “fever” was first projected to not exist, then was expected to break as it first started, constantly forecasted to break as it rose, and is again forecasted to break. In other words, the forecast above is the same forecast of the last four years. Wherever inflation is, it is headed straight back to 2%.

This is definitely the case for the United States. All these charts come from a monthly survey of dozens of economists conducted by Bloomberg.

Conclusion

We have argued the economy is now different from its pre-pandemic version. This means the economy behaves differently and one of the results is constant friction or inflation.

The end of globalization (cheap labor), re-shoring from China (less cheap “stuff”) and now the end of cheap energy from Russia means secular changes are occurring. Just waiting is not going to fix these issue. The economy must be restructured for this new reality.

The charts above suggest very few economists agree with this assessment. Implied in these forecasts is nothing has changed and a return to 2019 is forthcoming. This inflation surge is just an echo of the pandemic and once it passes, everyone is returning to the office, globalization will continue to pressure wages lower, cheap stuff will again flow in abundance from China, and energy prices will remain dirt cheap thanks to Russia.

This also means central banks can cut rates back to zero and “print” financial markets higher.

Instead we see higher volatility and a reluctance to restructure. Once this restructuring is accepted and implemented, inflation and market volatility can settle down.

So, look at these forecasts not as a “fever” breaking, but as a belief that nothing has changed from 2019. We challenge that assumption.