Once-in-a-Generation Wealth Boom

Ends for America’s Middle Class

The American middle class is facing the biggest hit to its wealth in a generation going into the midterm election, although it is also entering the vote richer than it has ever been thanks to a decade of cheap money and the wealth boom it fed.

That’s the conclusion of a Bloomberg News examination that paired new wealth data with an exclusive Harris Poll of attitudes of the 100 million adults who sit at the core of the US economy and its politics ahead of the election.

Middle-class fortunes have long determined the political fate of US leaders. The group is responsible for half of consumption expenditures in the US and its members are more likely to vote than people further down the income ladder, the data show.

In interviews, middle-class Americans—from retirees in Ohio and Michigan to first-time homebuyers in Wyoming—expressed anxiety about the future of the economy and the impact of inflation, but also optimism about both their own finances and the future of their children.

Middle Class Wealth Peaked in March and Is Now Declining

Falloff follows unprecedented five-year rise

To be middle class in America is about more than salary or wages: real economic security is driven by wealth and the ability to both access it and pass it on to the next generation.

And in March of this year, the average real wealth of the American middle class—including home equity and other physical assets as well as retirement and other savings—peaked at $393,300, the highest it’s ever been, according to data assembled by economists at the University of California, Berkeley.

The upshot is a US economy, and a core consumer class, that’s better placed to absorb the shocks of a looming recession and yet, as polls show, also more nervous about that cushion and the economy than it has been in years. Those anxieties also come at a crucial time for US politics, as President Joe Biden’s Democrats seek to defend thin majorities in Congress.

The March pinnacle for middle-class wealth capped a five-year period of accumulation—spanning two presidencies and made possible by historically low interest rates—that has been the most remarkable in the past half-century.

The average middle-class adult in America at that peak was more than $120,000 richer than they were when Donald Trump took office in January 2017, the data show.

Those gains fueled a pandemic boom in things like home renovations, and helped families weather rising consumer prices.

But that era is fading, if not over.

The average wealth of adults in what the Berkeley economists call the “middle 40%”—the population whose wealth falls in the 50th to 90th percentile—had by the close of business Oct. 25 fallen about 7%, or by more than $27,000 to $366,100, since that March peak, they estimate. That’s already the biggest hit seen since the 2007-09 global financial crisis.

There’s also good reason to think a slide is just getting started. That could have significant implications for the economy as well as elections not just this year but in 2024 when Democrats will try to maintain their hold on the White House.

Consumers are likely to cut back purchases as financial circumstances become more perilous. And even in a year when momentous social issues are on the ballot, economic anxieties and realities will shape plenty of votes.

The Harris poll of middle-class voters conducted in the leadup to the midterms for Bloomberg News found that while 86% said their personal financial situation was good right now, one in five expected it to get worse in the next year.

Twice as many said they felt either stressed or anxious about the current state of the US economy as those who felt calm. Only 26% said they felt optimistic.

Though there is a partisan divide. Going into this election middle-class Republicans are more stressed and less optimistic about the economy than their Democratic peers.

Republicans Are More Troubled by the Economy Than Democrats

When thinking about the current state of the U.S. economy, which of the following emotions do you feel? Please select all that apply.

The problem confronting middle-class families is that while inflation is eating away at their incomes and purchasing power for everything from food to vacations, the wealth that many could draw on to cushion the blow is now being hit too. That’s thanks to the Fed’s efforts to fight inflation by raising borrowing costs to slow the economy.

Already, the S&P 500 is down 19% this year on fears of a looming recession. The average rate on a 30-year fixed rate mortgage, the foundation stone of middle-class wealth since the 1940s, has more than doubled in a year to its highest level in two decades with existing home sales tumbling to 15-year lows.

That backdrop isn’t lost on the middle class. Speak to its members around the country and you run into a tension between the build-up of wealth that many have enjoyed in the past five years, and their anxiety and stress about the economy.

All of which will be on the minds of voters when they go to the polls Nov. 8.

Housing Wealth is Paper Wealth, Isn’t It?

Tom Maley, 71, retired as an optometrist just before the pandemic and like many in the US middle class who responded to the Harris poll, he and his family have benefited from the surge in home prices. His home in the suburbs of Columbus, Ohio today is worth considerably more than it was when he bought it. Over the last 5 years, the average homeowner in the Columbus area has seen their equity position increase by almost $108,000, according to data compiled by analytics firm CoreLogic.

But he is also more conservative than most when it comes to thinking about that wealth.

“There's only two times when the value of your home is meaningful: The day you buy it and the day you sell it,” Maley says.

He got a reminder of that when one of his three adult sons was relocated from Maryland to Ohio for work earlier this year and went from a sub-3% mortgage to one with a 6% interest rate as a result. “That wealth effect is negated real quick when you have to move,” Maley says.

The reality is that much of the wealth in the American middle class is tied up in property, which also means it’s not as easy to access as that held in more liquid forms. In the past five years the middle 40% has seen the value of its equity in homes rise by $5.7 trillion to almost $17 trillion, or roughly 60% of America’s total housing wealth, according to Fed data.

First Class Growth in Middle Class Assets

Home prices boosted household totals the most in past 5 years

That surge in housing wealth helps explain a growing social divide and tensions between US homeowners and renters for whom owning a home has grown even more unlikely even as rents soar, says Gabriel Zucman, one of the Berkeley economists.

He also sees something bigger on the horizon.

“We might be at the turning point” for wealth accumulation, Zucman says—the end of a 40-year period in which that growing wealth insulated much of the American middle class from the effects of stagnant incomes, rising inequality and, lately, inflation.

Then again, even in normal times few people move and housing wealth can act as a shock absorber for the economy.

Mischa Fisher, an economist who specializes in housing and teaches at Northwestern University, argues that the property wealth that the American middle class is sitting on now is a cushion in a recession, not just for them but for a consumption-driven economy.

In the five years through June of this year homeowners in sunbelt metro areas like Lakeland-Winter Haven, Florida and Phoenix-Mesa-Scottsdale, Arizona have seen gains in excess of 200% according to data from CoreLogic. In more than half of states, the CoreLogic data show, equity gains added in excess of $100,000 to homeowners’ wealth, led by a massive $298,000 gain for the average Californian homeowner.

Average 5-Year Gain in Equity in Top 100 Metro Areas

Housing wealth has become even more important to this middle class cohort. Five years ago, the middle 40% held one-third of their wealth in real estate. This year, that share increased to 36.2%, by far the largest asset component for the group.

While Maley’s been a beneficiary, he’s bracing for tougher times and plans to vote Republican in the midterm election with the state of the economy the most important issue to him, he says.

He and his wife have already cut back on spending.

“This is not the first rodeo that I've been in with double-digit inflation,” he says.

Thirtysomethings and First-Time Home Buyers

For millennial families who got on the property ladder more recently, the combination of high inflation and rising interest rates is being felt differently.

Brandi Romero and her husband moved to Casper, Wyoming, from Louisiana three years ago looking for a better quality of life and their own version of the American middle-class dream. They bought a home last year in which they are looking to raise their five children, ages three to 15.

"So that part we got,” says Romero, a veteran and former police officer who now stays at home with the kids and declined to talk politics or reveal who she planned to vote for Nov. 8. “But then kind of everything else has gotten expensive since we moved here."

The US Mountain states, which include Wyoming, continued to see the highest inflation in the country last month, with a 9.6% annual rise in consumer prices that’s well above the national average.

Prices Are Rising Fastest in Mountain States

To help pay bills and for the gas she needs to ferry the kids to school each day Romero drives for Uber and Lyft. She still worries about being able to afford visiting family in Louisiana or sending her kids to college one day. She and her husband made the difficult decision to pull their children out of school sports because they couldn’t afford the travel involved.

They’re not alone. Nearly 80% of middle-class respondents to the Harris poll said they were cutting back their spending.

As Inflation Rises, Americans Get Thriftier

How much have rising prices caused you to significantly cut back on your spending?

"It's hard to be optimistic because there's been no stability behind anything," Romero says. But "optimistically, I hope that they get better."

Millennial members of the middle class like Romero, who is 36, are actually more optimistic about the year ahead than older middle-class Americans, the Harris poll found. More than half of those millennials thought their financial situation would be better a year from now than they are now versus just 37% of Generation X respondents and 18% of baby boomers.

Middle Class Millennials Are More Optimistic

Thinking of the future, what do you expect your financial situation to be in the next year?

The Kids Are Going To Be Alright, Right?

The progress of the American middle class is often measured in generations. People like to know they have done better than their parents—and that their children will do better still.

For all the dislocation that the pandemic caused and all the gloom out there about a looming recession, people in the American middle class are remarkably optimistic about the long-term, believing that their children will land well.

GOP's Middle Class Is a Bit Less Hopeful About Kids' Prospects

Thinking of your children's future income and wealth, do you think they will be financially better or worse off than you?

Two-thirds of middle-class adults polled by Harris said they expected to be in a better financial situation a decade from now than they are today and 81% thought their children would be better off than their parents. Though there was a modest partisan divide. Just 77% of middle-class Republicans felt optimistic about their kids’ future versus 85% of Democrats.

To Gale Benington, a retired psychologist who lives outside Lansing, Michigan, with her husband, a retired high-school teacher and basketball coach, coping with rising prices has just been a continuation of the austerity the couple embraced during the pandemic.

They still drink a glass of wine with dinner each night. They just don’t go out for dinner or movies as much as they used to. Coping with inflation is something she sees as her patriotic war-time duty given she blames Vladimir Putin more for rising prices than President Biden. She plans to vote for Democratic candidates in November’s election.

If you want to gauge the resilience of the American consumer, her daughter may be the better example, Benington says, which gets at why she’s so optimistic about her child’s future.

The 24-year-old biomedical engineer already earns more than Benington’s husband ever did as a teacher and spends more freely than Benington ever could or would.

“She’s constantly telling us ‘I’m so rich, I’m so rich’,” Benington says. “She’s actually at a place where if she wants something, she gets it. I’ve never been at a place like that.”

That American Dream

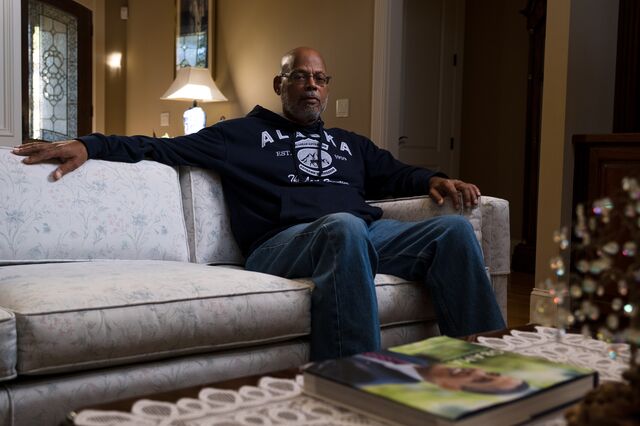

Joining the middle class remains a core component of the American Dream and as a Black man, Tony Grice is living his own complicated 21st century version of that dream. Born in Philadelphia, Grice went to college and graduated with a degree in accounting and finance. He spent 30 years working for the federal government before retiring to the outskirts of Raleigh, North Carolina.

Grice, 67, survives comfortably off a pension, social security benefits, and returns on investments he and his wife made over the years. It is a middle-class retirement to be envied that speaks to a broader prosperity in the US.

Not only do middle-class Americans have more wealth in property, but they also have seen retirement savings grow over the last five years, even if those savings have taken a hit with this year’s market turmoil and that could be encouraging some to change their savings strategy.

The Harris poll found almost a fifth of middle-class respondents were already reducing or planning to reduce contributions to 401ks. Then again, 39% said they were doing the opposite and increasing or planning to increase payments to their 401ks.

Amid Turmoil, Many Boost Investments

How much have your contributions to a 401(k) account changed since last year?

The strong financial position of the middle class may help explain why they feel more optimistic than most about the attainability of the American dream, with 60% seeing it as achievable versus 49% of the general population. That, too, is a matter of partisan disagreement: Half of Republicans in the middle class see an attainable dream, compared with two-thirds of Democrats.

Land of Plenty Seems Unreachable to Many Outside of Middle Class

How attainable is the overall American dream today?

And yet while Grice is comfortable he is also among the disillusioned, a Black man in a country still waking up to its racism. He’s contemplating a permanent vacation outside of the US, a move to Mexico perhaps. He may be a comfortable member of the middle class. He’s just concerned the country is too divided to fix.

“I don't want to live the rest of my life in a country of conflict,” Grice says.

To Grice, being a member of the middle class carries less meaning in a country that he sees as economically divided into “the poor, the working poor, the comfortable and the wealthy.”

He will vote for Democrats in this midterm election. And yet he’s not convinced the result will matter. Even if he’s optimistic about his own economic present and future, he isn’t confident about where America or its economy is going.

Which in 2022 is what many middle-class voters seem to be thinking going into this election.